The Federal Reserve (Fed) left its policy rate unchanged at the July meeting and announced it expects to continue buying U.S. Treasury and agency securities at the current pace for the foreseeable future. Treasury yields were little changed following the widely anticipated statement, but risk assets staged a rally into the close on the heels of Chairman Powell’s comment that the Fed ‘is not even thinking about raising rates’ and is “committed to using its full range of policy tools” until it achieves its dual mandate of full employment and price stability.

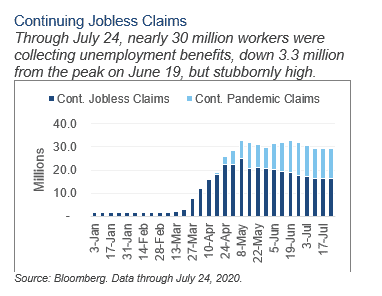

Although household financial conditions improved since May, the Fed had observed a slower pace of economic activity since mid-June when positive case counts began to rise. Powell acknowledged the future economic path depended on the course of the virus, renewed mitigation efforts and progress toward a treatment. That said, the Fed’s base case calls for a slow labor market recovery, which appears reasonable given the stubbornly high level of continuing jobless claims.

The next few weeks will offer additional economic signposts, notably, second-quarter GDP growth and non-farm payroll data, retail sales. Many supplemental household financial assistance programs are also set to expire, setting up for a potential spending cliff should Congress delay another round of fiscal stimulus.

Investors should remain vigilant as global economies stabilize and recover. In these uncertain times, we encourage investors to stick with a thoughtful asset allocation that aligns with their investment horizon.