May 2022

Leading into 2022 volatility was expected to be on the rise. Add in war, spiking inflation, and increasing interest rates, and you have the perfect environment for a market correction.

Historically bonds have helped mitigate the sell-off in equities, but due to the rising interest rates (which is needed) 2022 has seen both the equity and bond markets negatively correcting. None of these events will last forever, they will run their course. As we have shared, market corrections are to be expected every 2-3 years. Volatility on the upside can be exciting but on the downside it’s not enjoyable. It is a normal part of investing and allows the market to correct for the surrounding economic and market conditions.

During corrections it is critical to maintain discipline and let the process and due diligence on your investments work. The below charts can help keep things in perspective.

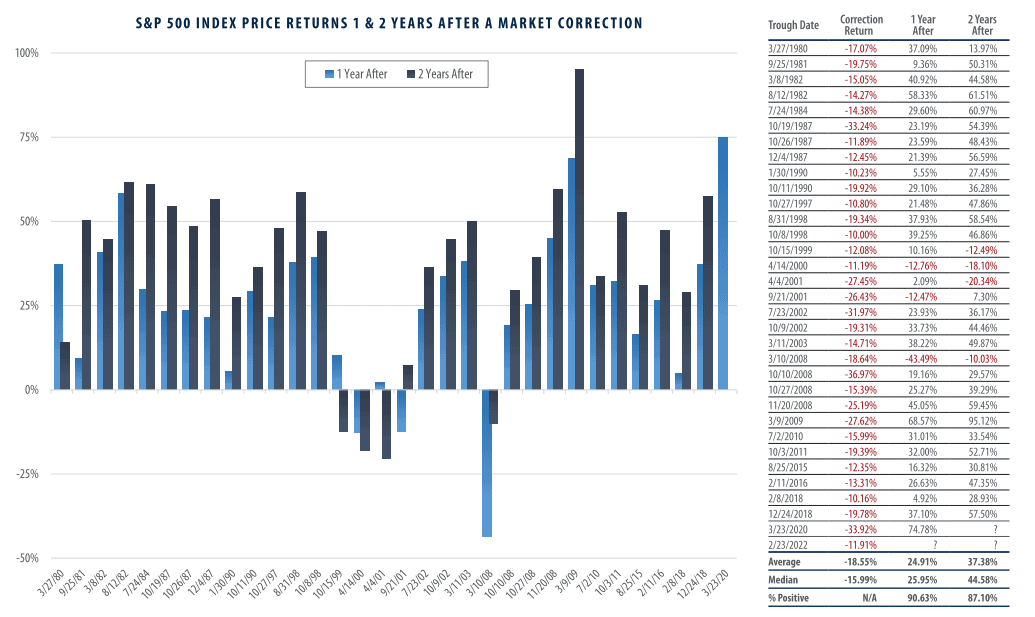

- This chart illustrates market corrections over the last 40 years.

- It further illustrates the returns following the 1-2 years after the correction.

- While not a guarantee of future returns, the percentage of positive years after a correction is a compelling fact.

Stock Market Corrections & Subsequent Year Returns

S&P 500 Index

Source:Bloomberg. First Trust, Client Resource Kit. Wars, Geopolitical Shocks & The Stock Market, Page 6, 2022. Performance is price return only (no dividends). Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. Market correction: When the market fell at least 10% from its recent peak. Index returns do not reflect any fees, expenses or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index.

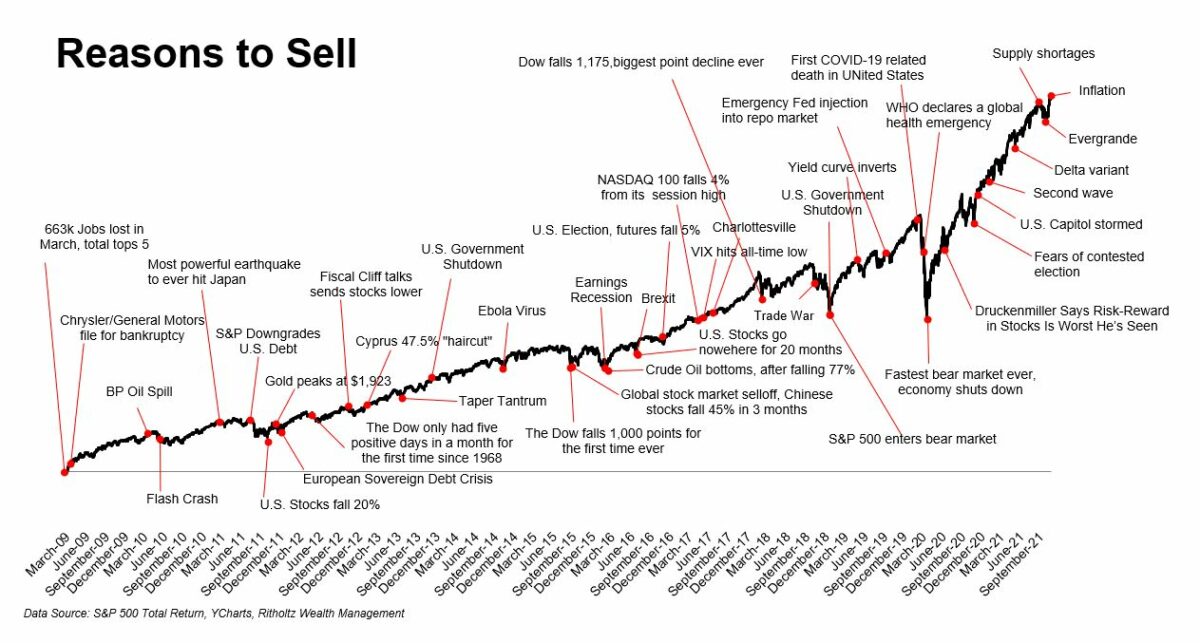

Climbing the 10-Year Wall of Worry

There have been numerous events over the past 10+ years that would have suggested a possible end to the sustained bull market.

- All corrections create anxiety and the emotional response to do something or “get out”.

- As we have stated time and time again, in most cases reacting in such a way will do more damage to your investments than the market would.

- This chart shows extreme negative situations over the last 10 years. As you can see, the markets may have temporarily reacted negatively (as you should expect), but it doesn’t last. Capitalism moves on and so do the markets.

Past performance is no guarantee of future results.

MPS LORIA has procedures in place to proactively and continually complete due diligence on all managers used within firm approved allocations. We proactively rebalance client accounts for both strategic and risk-related reasons. This allows your allocation to stay properly aligned to help reach your long-term goals. These processes are further reinforced by MPS LORIA’s CEFEX (Center for Fiduciary Excellence) certification. CEFEX conducts annual audits of MPS LORIA to confirm we are continuing to perform fiduciary best practices on behalf of our clients. Only 1% of Advisory Firms in the state of Illinois have this certification.

We value the trust you have placed in MPS LORIA, and we look forward to helping you continue to reach your long-term goals. If you have any questions or would like to review your investments or planning goals, please contact our office.

All advice is offered through: MPS LORIA Financial Planners, LLC, a registered investment advisory firm. Securities offered through: LORIA Financial Group, LLC, a registered broker dealer; member FINRA & SIPC. Please read all investment material carefully before any investing. It is important to consider all objectives, risks, costs and liquidity needs before investing. Please contact an investment professional for a copy of any investment’s most recent prospectus. MPS LORIA Financial Planners, LLC and LORIA Financial Group, LLC do not provide tax or legal advice. All information provided is for informational purposes and it is at the sole discretion of the client on how or if they proceed with any implementation of such information. As it pertains to tax or legal topics the client must discuss with their CPA or attorney before proceeding. MPS LORIA Financial Planners, LLC nor any of its affiliates, members, directors or employees can be held responsible for use of information provided. While reasonable efforts are made, information provided is not guaranteed to be accurate. This report is intended for the exclusive use of clients or prospective clients of MPS LORIA Financial Planners, L.L.C. Content is privileged and confidential. Dissemination or distribution is strictly prohibited. Information has been obtained from a variety of sources believed to be reliable though not independently verified. Any forecasts represent future expectations and actual returns, volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is a possibility of a loss.