In June 2022 it appeared as though the markets may have hit a low for the year. Markets then provided a short-term rally but inflation data, which was not as good as the markets wanted, was released. The markets then sold off through the end of September creating new lows for the year.

The core issue continues to be inflation. The markets need to see reasonably clear data that inflation has peaked and is beginning to abate. In turn, the Federal Reserve would consider a pull back on aggressive rate hikes. There are other risks, but this is the key economic variable on which the markets are focused. As we have said in the past (and will continue to reiterate during corrections/bear markets) discipline is critical. Down markets are never fun, but they are a normal part of investing. Investing must be viewed over years not months. The worst mistake an investor can make is giving into fear, emotion or drama and reacting poorly in the middle of a sell-off.

Remember for accounts that are in firm approved allocations MPS LORIA proactively provides the 3 key aspects to money management which will allow you to navigate through these volatile markets:

- Independent due diligence: Money managers utilized within the approved allocations are some of the best in class when it comes to fees, performance, and management.

- Risk Rebalance: Allows your allocation to stay properly aligned to your agreed upon risk profile to help reach your long-term goals.

- Strategic Rebalance Proactively position your monies in the best asset classes based on forward looking capital market assumptions provided by a respected research firm.

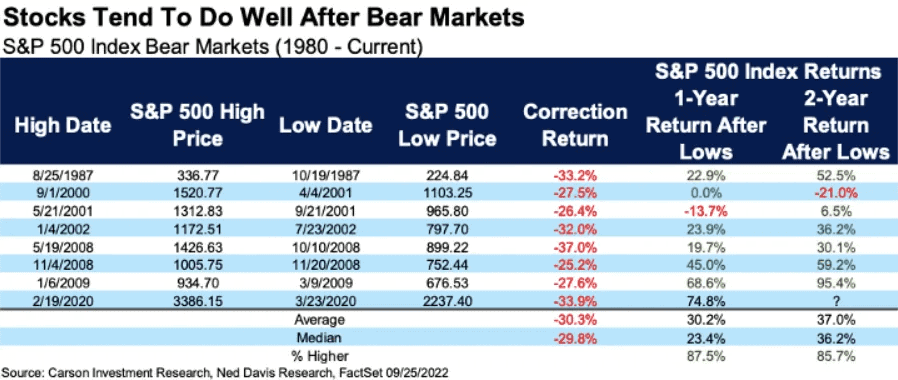

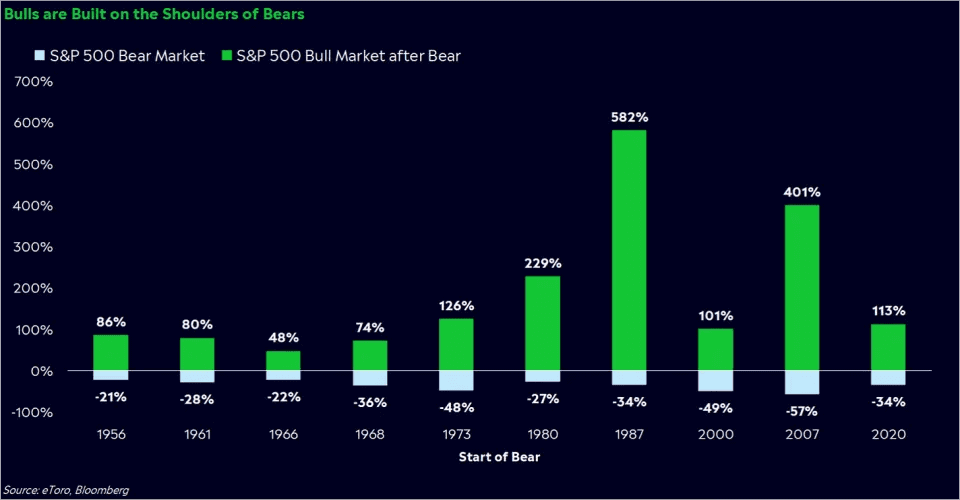

Additionally, history can be a powerful tool. The following two charts illustrate how markets have historically responded after a bear market. As you will see, it builds a very strong case for disciplined long-term investing. There is an expression, “time in the market matters more than timing the market”, which historically has proven to be the case.

Important contrast of the higher weight of positive returns vs. negative returns over time.

We value the trust you have placed in MPS LORIA, and we look forward to helping you continue to reach your long-term goals. If you have any questions or would like to review your investments or planning goals, please contact our office.