We wanted to reach out to you due to the recent market sell-off. After a very strong 2019 the stock markets were due for a pull back. The question is what would be the catalyst for this sell-off? It has come in the form of a virus (COVID-19) and most recently an oil war between Saudi Arabia and Russia has been added to the mix.

Sell-offs are due to bad news and never comfortable to live through, but they are part of investing. The key is how you respond which will dictate how the sell-off will impact you. The stock markets in general are not suddenly worth 15-20% less today than they were at the beginning of the year because of a virus or an oil war. This market drop is due to panic based on much speculation (much by the media’s desire for high drama reporting) and real valuations should eventually come back to reality. We are not diminishing the illness or deaths attributed to this COVID-19, one death is too many. Based on current information the situation will worsen before it improves. However, reacting poorly to a sell-off based on speculation is one of the worst strategic decisions a person can make.

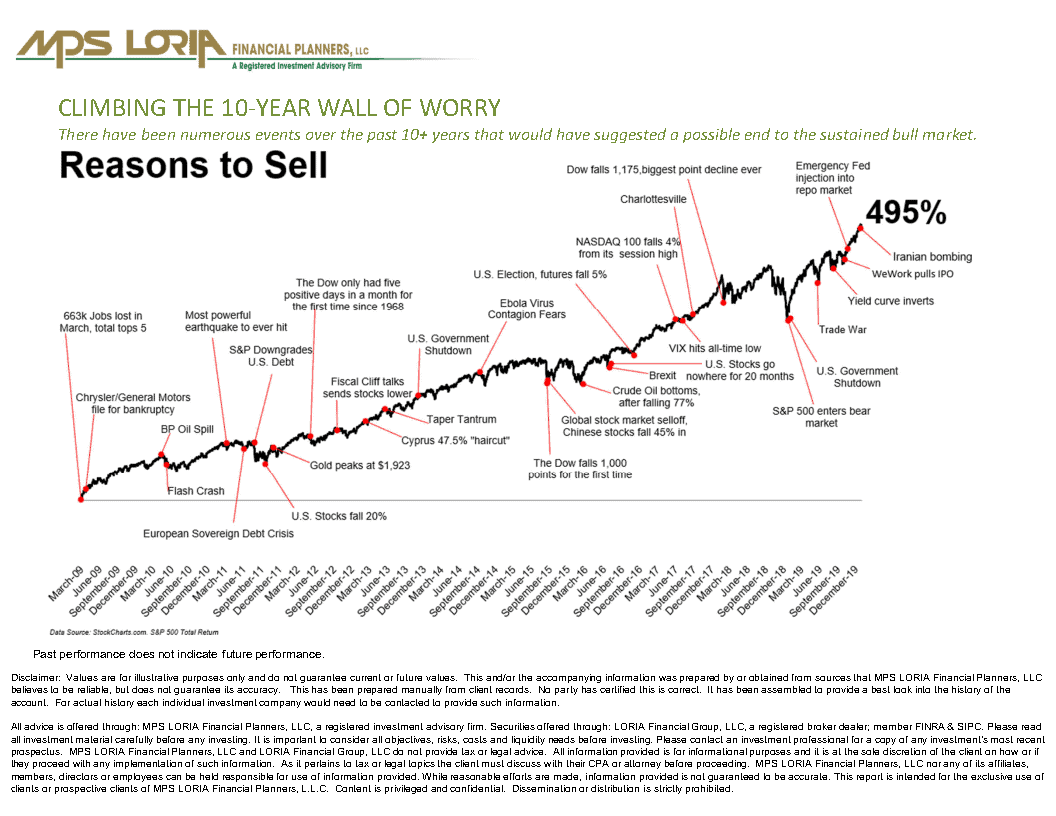

- Please refer to the below chart titled, “Reasons to Sell”. Many of the negative sell-off events from the past 10 years are highlighted. If a person would have sold based on emotion or panic, they would have suffered much more financial damage than the markets would have created. Current drops in portfolio values are paper losses, they are not realized unless actually sold.

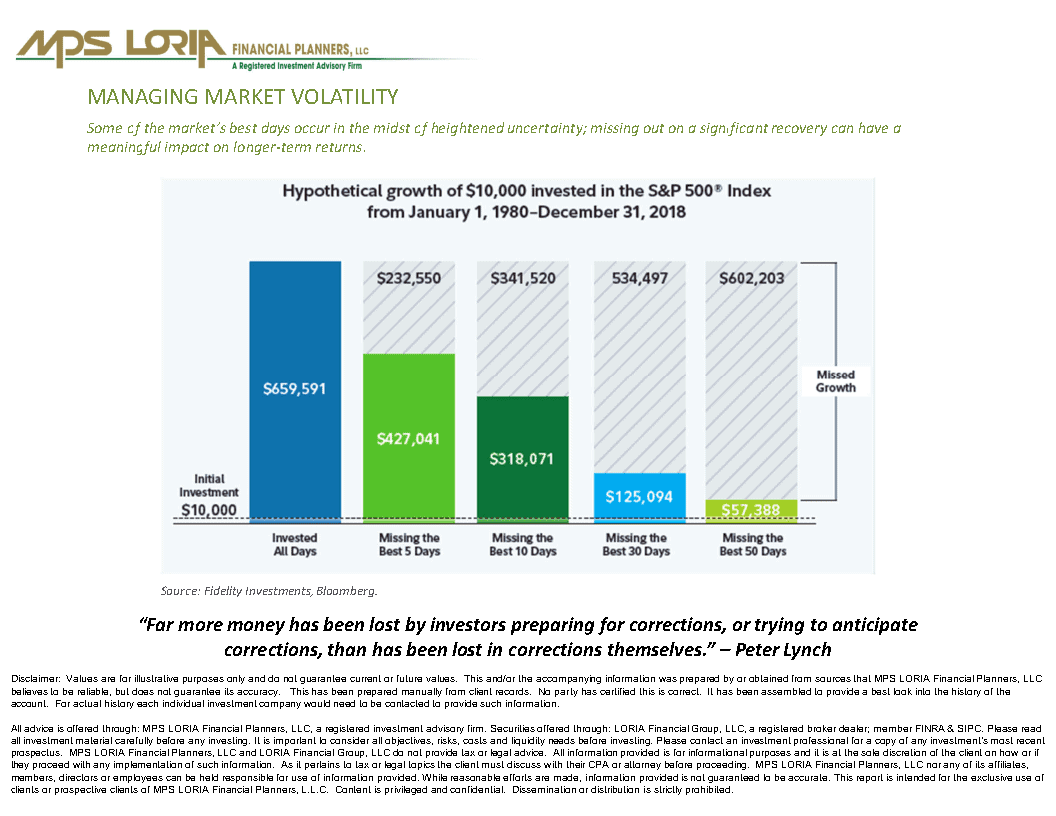

- Second, is a piece titled, “Managing Market Volatility”. The key take-away from this piece is the significant cost of selling out of a downward market and missing the critical rebound days. It is proven over time no one can properly time markets so exiting and then trying to re-enter markets is a very challenging and, in most cases, unsuccessful strategy.

It is important to know we are very aware of what is going on in the markets. Our due diligence and adjustments to allocations are continual and based on a disciplined process. While much attention has been given to the stock market sell-off, most clients also have bonds as part of their allocation. That portion of the allocation is currently up which mitigates some of the stock market losses. Your allocations are built to be invested over years not months, so reacting to short term market movements (regardless of how extreme) takes away from the disciplined strategy and diversified allocation we have in place for you.

At the risk of sounding like we are preaching, we are extremely proud of our clients because they have maintained their discipline and in many cases are looking at this as an opportunity. We are always here to talk with you, and most importantly keep you from making any ill-advised decision during these volatile times. Viruses and oil wars do not last forever. As more clarity becomes available on the COVID-19 situation, good or bad, eventually the panic and speculation will calm down, as will the stock markets. Unless something has significantly changed in your life, remember to maintain your discipline.

If you have any questions, please do not hesitate to call. We hope everyone stays healthy and we appreciate your trust.