STIMULUS (HOPEFULLY) TO THE RESCUE

Congress Passes the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”)

March 2020

In response to the growing coronavirus pandemic and its resulting impact on the U.S. economy, Congress passed the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) on Friday, March 27. This phase three stimulus package, estimated at more than $2.2 trillion dollars, is the most expansive to-date and follows an earlier $8 billion bill (phase one) focused on vaccine development and prevention efforts and a $100 billion package (phase two) expanding paid sick leave, enhancing unemployment insurance and providing free coronavirus testing.

Why was this Stimulus Package Needed?

With as many as 229 million Americans under a ‘shelter-in-place’ order, the U.S. economy is expected to contract sharply in the second quarter. Initial unemployment claims soared to a record 3.28 million on March 26, confirming the U.S. economy was indeed slowing down. In early negotiations, Treasury Secretary Steven Mnuchin told GOP lawmakers the unemployment rate, currently at 3.5 percent as of February, could climb to as high as 20 percent without meaningful intervention. With lessons learned from the 2008 Global Financial Crisis, government leaders focused on an expansive stimulus package aimed at limiting the economic damage from the coronavirus.

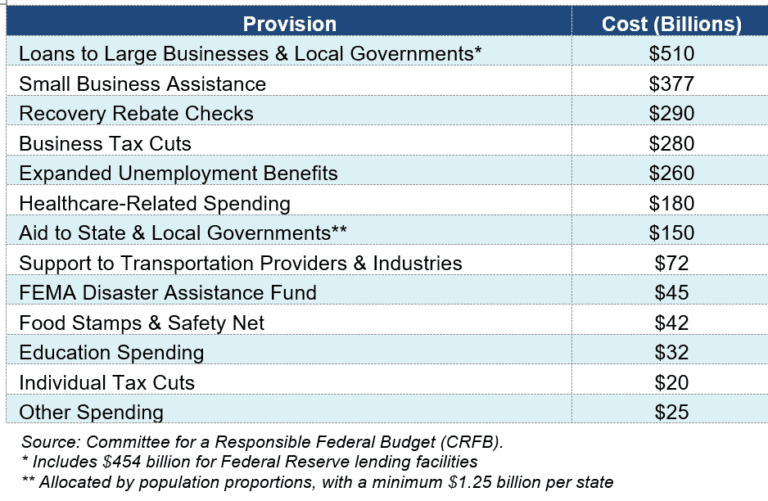

Where will the Stimulus be Directed?

Due to the extensive list of provisions contained with the CARES Act, the summary that follows focuses only on select provisions for individuals and retirement plans (the summary does not cover business-related provisions).

Individual Provisions:

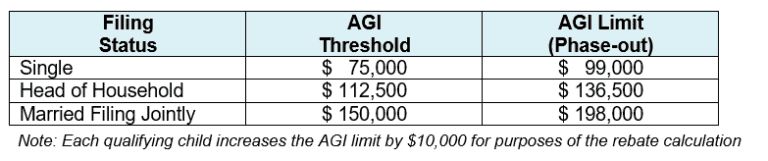

- Recovery Rebate Checks: One-time cash payment of $1,200 to individuals and $2,400 to married filing jointly couples, with an additional $500 for each qualifying child under age 17 (with no limit on the number of qualifying children). The payment is reduced by $5 for every $100 a taxpayer’s income exceeds the adjusted gross income (AGI) threshold.

The credit will be determined based on the taxpayer’s adjusted gross income (AGI) as reported on an already filed 2019 tax return, the 2018 AGI if the 2019 tax return has not yet been filed or information from the 2019 Form SSA-1099 if a 2019 or 2018 individual tax return has not been filed.

- Charitable Deductions: The Act suspends the AGI limitation for 2020 for qualifying cash contributions made to public charities (private foundations, supporting organizations and donor-advised funds do not qualify), thus allowing taxpayers who itemize deductions to elect to deduct up to 100 percent of their AGI remaining after accounting for all other charitable contributions subject to AGI limitations. The Act does not specify that such cash contributions be made for COVID-19 relief efforts. For taxpayers that do not itemize deductions, the Act provides for a new “above-the-line” charitable deduction up to $300.

- Expanded Unemployment Benefits: The Act provides for an additional $600 per week from the federal government on top of state-provided unemployment benefits. The federally paid increase will last for four months. Unemployment insurance is also extended through December 31 for eligible workers.

- Pandemic Unemployment Assistance: The Act creates a new, temporary program to assist self-employed individuals, freelancers and contractors who lose employment due to the public health emergency. The program will run through the end of 2020.

- Coronavirus Testing: All testing and potential vaccines will be covered at no cost to patients.

- Tax Returns: The April 15 federal income tax filing and payment deadline is extended to July 15. Since the federal government’s announcement, many states have followed suit with a similar extension.

Retirement Provisions:

The retirement-related provisions within the CARES Act (Section 2103) provide those in need with easier access to their retirement funds, delays most Required Minimum Distributions (RMDs) and provides some relief to defined benefit plans. It is important to note the withdrawal and loan provisions detailed below are “optional” for Plan Sponsors and are only applicable for a “qualified individual” as defined in subsection (a)(4)(A)(ii)) as follows:

- who is diagnosed with COVID-19 by a test approved by the CDC

- whose spouse or dependent is diagnosed with such virus, or

- who experiences adverse financial consequences as a result of being quarantined, furloughed, laid off or having work hours reduced due to such virus, being unable to work due to lack of child care due to such virus, closing or reducing hours of a business owned or operated by the individual due to such virus or disease, or other factors as determined by the Secretary of Treasury.

(a) Tax-Favored Withdrawals from Retirement Plans (including IRAs)

- This is an optional provision

- Coronavirus-related distribution may be taken from an eligible retirement plan before December 31, 2020

- The 10 percent additional tax (penalty) on early distributions from qualified retirement plans does not apply to any coronavirus-related distribution

- Aggregate dollar limitation by an individual shall not exceed $100,000 (from all plans maintained by the employer – same controlled group)

- Coronavirus-related distribution may be repaid at any time during the three-year period beginning on the day after the date on which such distribution was received. Any repaid amount is treated as a rollover and is not included in gross income.

- Distribution may be included in gross income (for income tax purposes) ratably over three years beginning in 2020

- Plan administrator may rely on employee self-certification

(b) Loans From Qualified Plans

- This is an optional provision

- Applicable for qualified individual taking a loan during the 180-day period beginning on the date of the enactment of the Act

- Increase the dollar limit on loans to $100,000 from $50,000 and increase the percentage limit to 100 percent from 50 percent of the present value of the employee’s vested accrued benefit

- Repayment of new qualified loans, and existing loans, may be suspended for up to one year. At the end of the one-year suspension, the loan balance and accrued interest must be re-amortized.

(c) Required Minimum Distributions (RMDs)

- Suspension of RMDs for calendar year 2020 from qualified defined contribution plans and IRAs (defined benefit plans excluded)

(d) Plan Amendments

- Non-governmental plans have until the end of 2022 plan year to adopt necessary plan amendments. Governmental plan have an additional two years (end of 2024) for amendments.

(e) Defined benefit plan relief

- 2020 ERISA-required minimum contributions delayed to January 1, 2021 (note, interest will be added to amount due)

- Plan may use 2019 funded ratio for determining benefit restrictions

Plan Sponsors should work closely with their ERISA attorney and recordkeeper to carefully consider whether to implement the optional withdrawal and loan provisions and what plan amendment(s) may be required.

Could Further Stimulus be Ahead?

Shortly following the passage of the CARES Act, discussion already began over the potential for another emergency spending bill to avert further economic damage, with debate possibly starting by late April. Senate Minority Leader Chuck Schumer noted, “This is certainly not the end of our work here in Congress – rather the end of the beginning.”