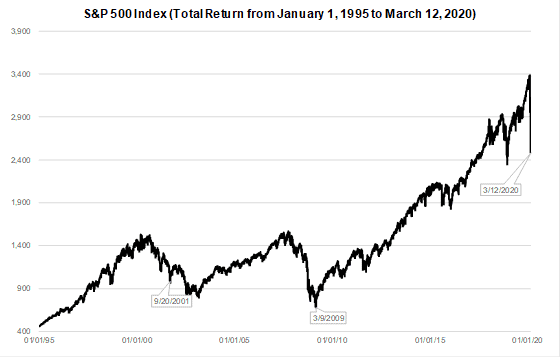

March proved to be one of the most volatile months in the history of the stock market. We’re officially in bear market territory and it happened very quickly. As the unfolding human and financial damage from COVID-19 hits the population and market participants, memories of the 2008 financial crisis and the immediate aftermath of the 9/11 attacks come to mind. While the 2008 financial crisis is perhaps burned more deeply into our collective brain given its relative recency, it is our view that the immediate aftermath of the 9/11 attacks are a more apt comparison for the COVID-19 crisis. As you recall, immediately after 9/11, fear understandably gripped the population and markets and meaningfully impacted economic activity as travel was shuttered and people were generally fearful about leaving their homes. In the COVID-19 case, while the onset of fears were more subtle and gradual, the economic consequences are likely to be longer-lasting and further-reaching than 9/11.

So, what active steps and thoughts does MPS LORIA have throughout this situation as it pertains to you?

- This is a very difficult environment on a basic human level and on a financial level. There’s nothing we can tell clients that will be a panacea to all their concerns. Many clients are likely splitting their anxieties between human and financial concerns. However, what we can do is assure you that we have a plan and we are following it.

- While we are not market timers, we do not believe a mid-month rebalancing should occur (outside of normal cash flow rebalancing activity). Our disciplined Portfolio Engineer™ rebalancing process is designed with monthly snap shots in mind, to prevent the catching of (repeated) falling knives and getting whipsawed by daily volatility. Earlier this year we already proactively rebalanced your accounts due to large gains in 2019. With similar methodology we are anticipating further revisions to properly position your accounts due to the selloff experienced in March.

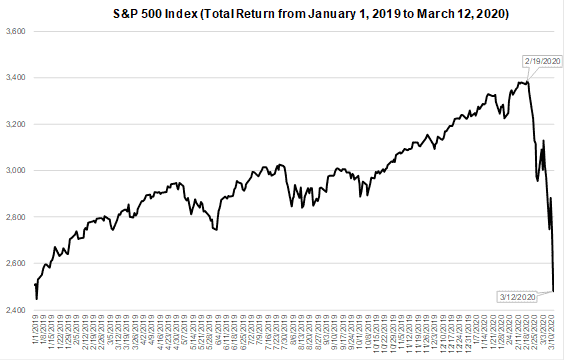

- The U.S. Stock market has returned to its January 2019 levels, so about a year of U.S. Stock Market returns have been erased in 22 days (since the February 19 peak). Your March statements will not look pretty, but remember any losses are not realized and only paper losses at this point. This is something we monitor closely.

- The economy is going to take a meaningful hit through at least mid-2020 and a recession is much more likely than it was several weeks ago. Certain sectors of the economy will be hit particularly hard, but virtually everything will be adversely impacted. However, it’s important to note that markets often rally well before buds of optimism start to grow. Many research reports support while the short term impact to the economy is large, the longer term impact as this passes will not be, which is the most important.

- Market volatility is going to remain extremely high for foreseeable weeks. It is our view that while we’ll likely have many up and down daily moves in the days ahead, we have unlikely seen a market bottom. However, going to cash today would require us to pinpoint the moment when the market will trough to get back in, and we simply cannot do that. Nobody can and that is why it is a losing strategy.

In summary, this too will pass. We wanted to reach out so you know we have been and continue to make proactive revisions to your accounts to keep them properly aligned with your long term goals and objectives. Remember, investing is based on years not months. In the meantime, we need to be ready to face the challenges that will unfold over the coming weeks and try not to get caught up in the emotional swings that can accompany this kind of market volatility. We’ve faced very difficult times in the markets and will face them again in the future.

All of us at MPS LORIA appreciate the trust you continue to provide us in being your financial planning firm. Do not hesitate to call us with and questions.